Social Security Tax Rate 2025. Other important 2025 social security information is as follows: 3 social security changes in 2025 to know.

3 social security changes in 2025 to know. You file a federal tax return as an individual and your combined income is more than.

Limit For Maximum Social Security Tax 2025 Financial Samurai, For 2025, an employer must. Social security tax wage base jumps 5.2% for 2025.

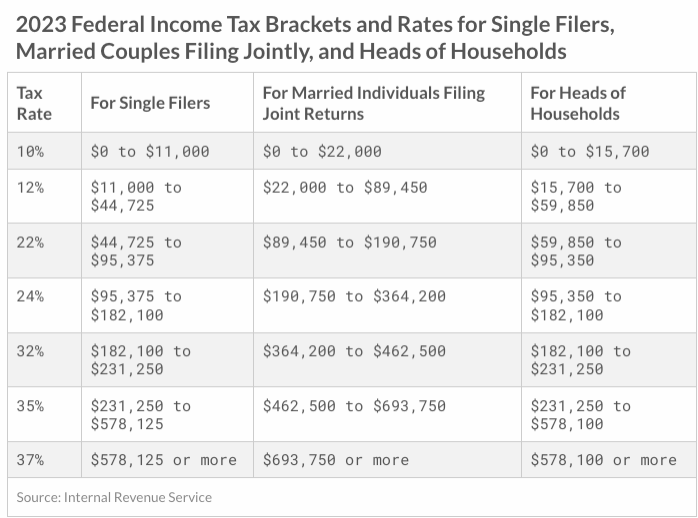

Social Security Tax Rate 2025 2025 Zrivo, (thus, the most an individual employee can pay this year is $10,453.). The limit for 2025 and 2025 is $25,000 if you are a single filer, head of household or qualifying widow or widower with a dependent child.

How To Calculate, Find Social Security Tax Withholding Social, The tax rate is 4.4%. Companies pay 15% and employees pay 9.5%.

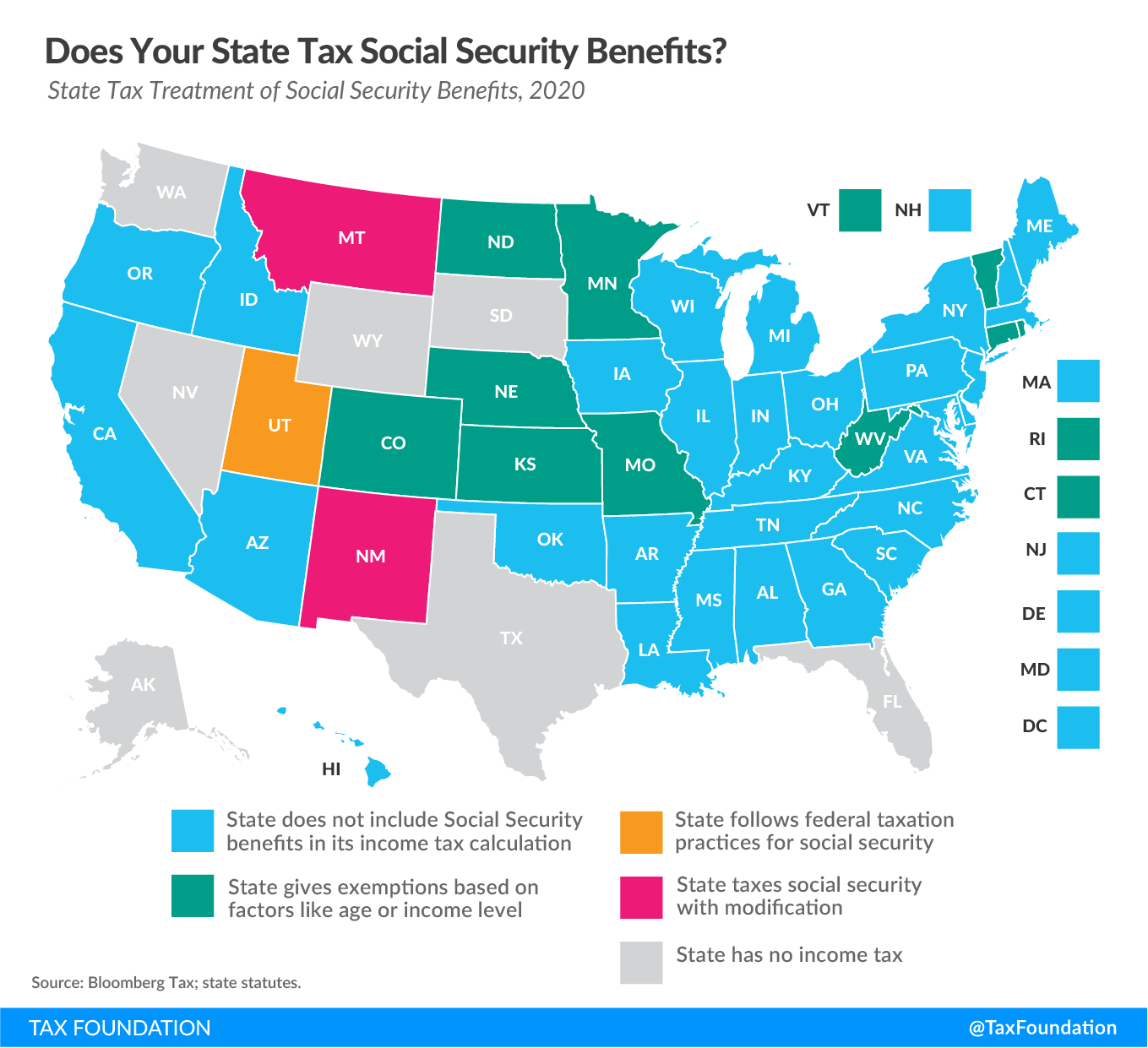

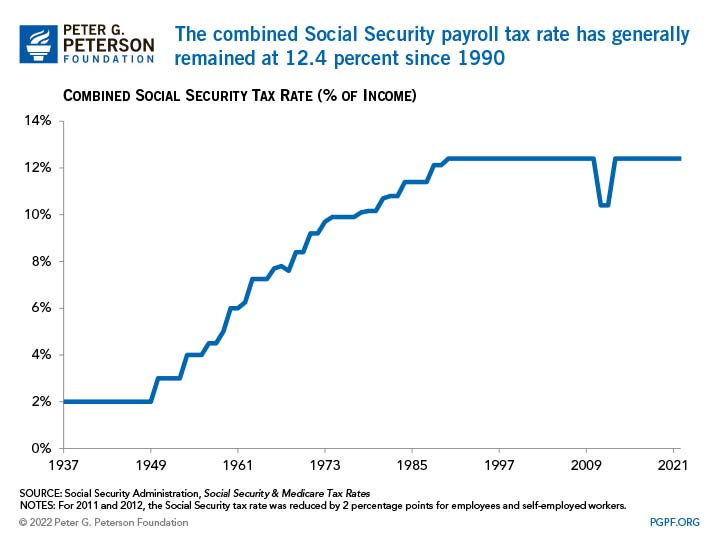

States That Tax Social Security Benefits Tax Foundation, The oasdi tax rate for wages paid in 2025 is set by statute at 6.2 percent for employees and employers, each. Other important 2025 social security information is as follows:

Social Security Wage Base 2025 [Updated for 2025] UZIO Inc, Thus, an individual with wages equal to or. For 2025, the sdi withholding rate increases to.

![Social Security Wage Base 2025 [Updated for 2025] UZIO Inc](https://www.uzio.com/resources/wp-content/uploads/2021/09/Social-Security-Wage-Base-Table-2023-1024x791.png)

2025 Tax Brackets, Social Security Benefits Increase, and Other, You will need to file a return for the 2025 tax year: By law, some numbers change automatically each year to.

Social Security Taxable Calculator Top FAQs of Tax Oct2022, For 2025, the social security tax. 3 social security changes in 2025 to know.

What Is The Taxable Amount On Your Social Security Benefits?, Social security and medicare tax for 2025. Wealthier taxpayers will have more social security tax taken from their paychecks this year.

Social Security Reform Options to Raise Revenues, By law, some numbers change automatically each year to. More than $44,000, up to 85% of your benefits may be taxable.

2025 Part D IRMAA Chart jpg.jpg, Social security tax wage base jumps 5.2% for 2025. People with combined income in the lower threshold will pay taxes on 50% of their benefit, and people with combined income in the upper threshold will.